Renters Can Afford to Buy a Home The number of renters who can afford a home has increased over the past two years, but achieving homeownership is still difficult for renters in saving up for a down payment, according to a recent post at the National Association of REALTORS®’ Economists’ Outlook blog. Thirty-eight percent of …

Tag: tips

Dec 07

Sellers Cool on Instant Offers as iBuyers Pull Back

Sellers Cool on Instant Offers as iBuyers Pull Back As iBuyers resume operations, they’re finding less sales activity coming their way as the housing market sees booming sales from consumers. Many iBuyers paused home purchases in mid-March as the COVID-19 outbreak began in the U.S. While most reopened over the summer, their sales levels are …

Dec 03

Do Open Houses Still Have a Bright Future?

Do Open Houses Still Have a Bright Future? Technology has changed the way many buyers shop for homes during the pandemic. As social distancing measures remain in place, the in-person open house has been put on hold in many markets. That has prompted some real estate professionals to believe open houses may become a thing …

Dec 02

Road to Freedom

Road to Freedom – Buying a home. Thinking about buying a home? Check out this roadmap from start to finish so you know what to expect during your homebuying process! With the help of myself and John Coneys of Freedom Mortgage, (NMLS# 183853 – 610.322.4886) we can explore homebuying options to help you meet your …

Dec 01

15 Cities With the Lowest Costs of Living

15 Cities With the Lowest Costs of Living With nearly half of Americans planning a move to reduce living expenses, according to a new study, many will be targeting cheaper towns. Move.org researched rent prices, utility costs, gas prices, and internet rates in the 75 largest U.S. cities to find the most affordable areas in …

Dec 01

What Real Estate Has to Be Grateful For in 2020

What Real Estate Has to Be Grateful For in 2020 No doubt, 2020 has been a uniquely challenging year. With unemployment still above pre-pandemic levels, the country coming to terms with longstanding racial inequities, Americans worrying about natural disasters and coming off a contentious national election, and the COVID-19 pandemic still raging, people are searching for reasons to feel gratitude this Thanksgiving. The …

Nov 30

Top New-Home Markets

Top New-Home Markets More buyers are being drawn to new-home construction during the pandemic. Construction of single-family homes last month soared to the highest level since the spring of 2007. New-home construction is up 8.6% from a year ago, the Commerce Department reported last week. The top performing new-home markets in October were Raleigh. N.C.; …

Nov 30

Americans Plan Move to Reduce Costs

Americans Plan Move to Reduce Costs Nearly half of more than 2,000 Americans recently surveyed say they plan to move soon to reduce living expenses, according to a new survey from LendingTree. Forty-six percent of respondents say they plan to relocate within the next year. The pandemic has motivated more Americans to consider a move. …

Nov 25

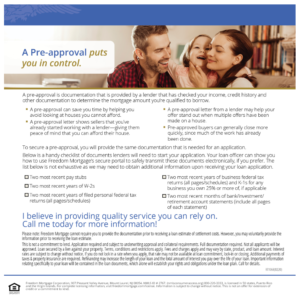

Pre-Approval Puts you in control

Pre-Approval Puts you in control Becoming preapproved early is important so we can be sure to show you homes within your budget and goals. With the help of myself and John Coneys of Freedom Mortgage, (NMLS# 183853 – 610.322.4886) you’ll have the information and confidence in your home buying decisions. #RealEstate #Realtor #HomePurchase #BuyersMarket #FreedomFast …

Nov 24

Home Sales Are Up 27% From a Year Ago

Home Sales Are Up 27% From a Year Ago For the fifth consecutive month, existing-home sales continued to be resilient in the face of the pandemic, climbing nearly 27% compared to a year ago, the National Association of REALTORS® reported Thursday. Also reported this week, construction of single-family homes soared to the highest pace since …

Nov 24

‘Essential Service’ Battle Is Back

‘Essential Service’ Battle Is Back Concerns in the real estate industry are mounting as more states move toward tougher coronavirus restrictions—including lockdowns in New Mexico and Oregon. As COVID-19 cases surge to a record high nationwide, at issue is whether states will deem real estate an essential service if they reinstitute mandatory stay-at-home orders. New …

Nov 23

Foreclosure Filings Are on the Rise

Foreclosure Filings Are on the Rise Foreclosure filings in October climbed 20% compared to September’s figures as the pandemic remains a threat to homeownership for some Americans and to the economy, ATTOM Data Solutions, a real estate research firm, reports. Foreclosure filings include default notices, scheduled auctions, or bank repossessions. “It’s a little surprising to …