Despite signs of a housing recession, some buyers will be back to try again.

The housing recession is here, but it’s not what you might think. There’s very little distress in the market, with less than 1% of home sales in foreclosure or needing a bank-approved short sale. Owners’ aggregate housing wealth, the asset valuation minus the outstanding mortgage, is at an all-time high of $32.1 trillion, a gain of $8.5 trillion since the pandemic began. A typical homeowner’s wealth has jumped to an estimated $320,000 versus a typical renter’s wealth of $8,000. Real estate investors are also gaining in terms of wealth and strong rent growth. There’s still a residual housing shortage. Inventory conditions are only modestly higher than the supertight conditions of a year ago. Home prices are up from a year ago in nearly every market across the country.

The economic recession refers to weaker and less income-generating economic activity. The housing recession is here because of reduced income for brokerage services and mortgage lending and the fall in home construction. Job cuts have been announced for people working in the housing industry. Consequently, the housing sector subtracted 0.7% from the gross domestic product in the second quarter. The GDP itself declined 0.9%.

The key reason for the housing recession was the sudden sharp rise in mortgage rates in the first half of the year. Mortgage rates perhaps overshot because of the uncertain outlook for consumer price inflation. However, with gasoline prices steadily falling and the U.S. dollar strengthening against other currencies, the inflation rate may already have peaked. Mortgage rates showed signs of stabilization in July and August. That means further home sales and construction declines could be over very soon. That’s not to say homes will sell like gangbusters, but sales will stabilize first and then resume modest growth as job creation in the broader economy brings about a new potential set of buyers. Some buyers who were priced out in early June may be ready to jump back into the market—a second-chance opportunity.

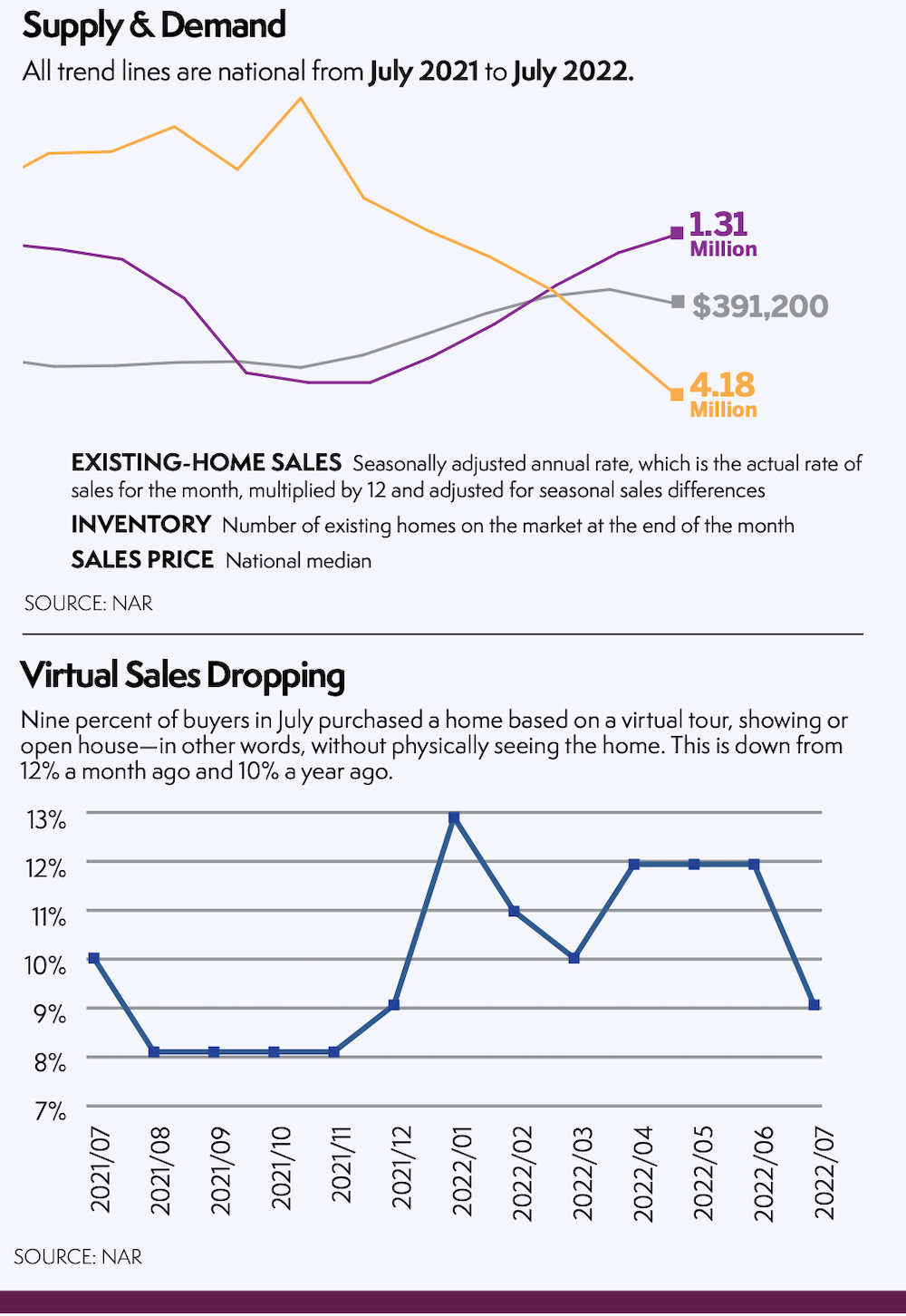

Housing Inventory Up

Total housing inventory for July was 1,310,000 units, an increase of 4.8% from June. At the current sales pace, unsold inventory sits at a 3.3-month supply, up from 2.9 months in 32% June and 2.6 months in July 2021.

©National Association of REALTORS®

Reprinted with permission