Rents Post Largest Uptick Since COVID-19 Onset

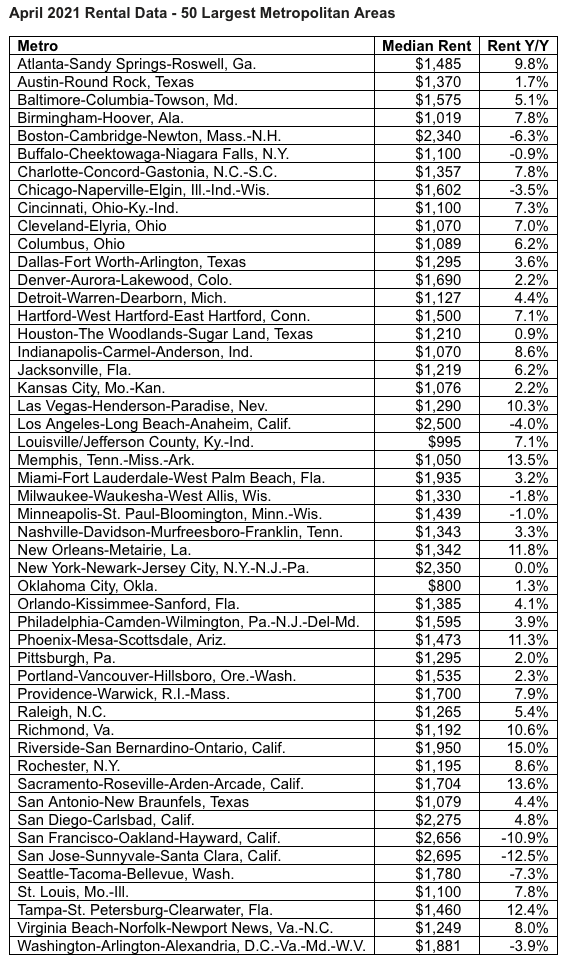

The median rent in the 50 largest metros nationwide increased 2.7% year over year, the largest growth since the beginning of the COVID-19 outbreak, according to a new report from realtor.com®. The nation’s largest tech hubs are seeing some of the biggest rebounds in rental prices as more technology firms announce return-to-the-office plans.

The U.S. median rent in April averaged $1,483, the fastest growth since March 2020. Prior to the pandemic, rents were growing 3.2% annually.

Rents for two-bedroom units are seeing the most growth, now surpassing pre-COVID-19 growth rates—up 5.2% annually, realtor.com® notes.

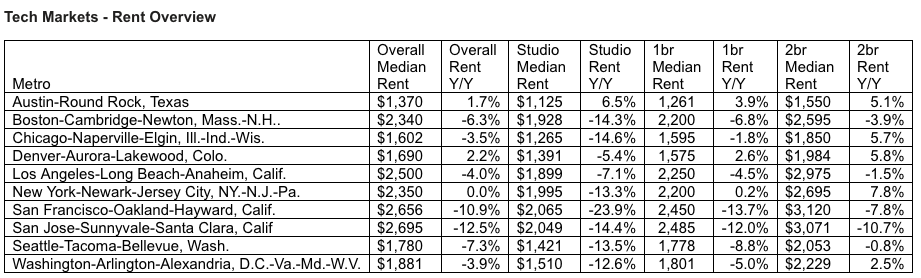

Rents in the largest tech hubs saw prices fall the most in 2020 due to the growth of remote work. Rents in tech hubs are still down 5.4% from a year ago but that marks an improvement from a 6.6% decline in February, realtor.com® notes.

“In tech centers, rent declines are getting smaller, signaling they are on the path to turnaround,” says Danielle Hale, realtor.com®’s chief economist. “If the trend continues, renters could expect to be paying pre-pandemic rates by as early as this fall.”

The median rent in the nation’s largest tech hubs was $2,086 in April, up 1.1% from March. Still, rents continue to be lower in the largest tech centers like San Jose, Calif. (-12.5%); San Francisco (-10.9%); and Seattle (-7.35). But the declines are lessening, researchers note. On the other hand, Denver and Austin, Texas, are leading the rental market recovery among tech hubs. The median rent in Denver is up 2.2% and is up 1.7% in Austin annually.

“Overall, the U.S. rental market is beginning to return to pre-pandemic levels,” says Hale. “With the largest growth occurring outside of major cities, renters are encountering different scenarios depending on the market in which they are searching and size of the unit they are looking for.”

Reprinted with permission