With surging home prices, more home buyers are showing an interest in manufactured housing. Even buyers who aren’t specifically looking for manufactured homes may discover that some listings they are interested in feature them, since they more closely resemble site-built homes nowadays.

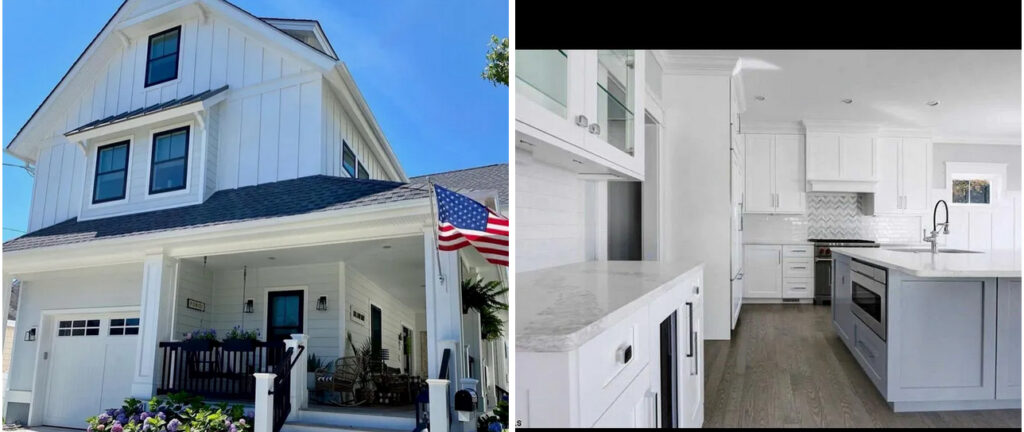

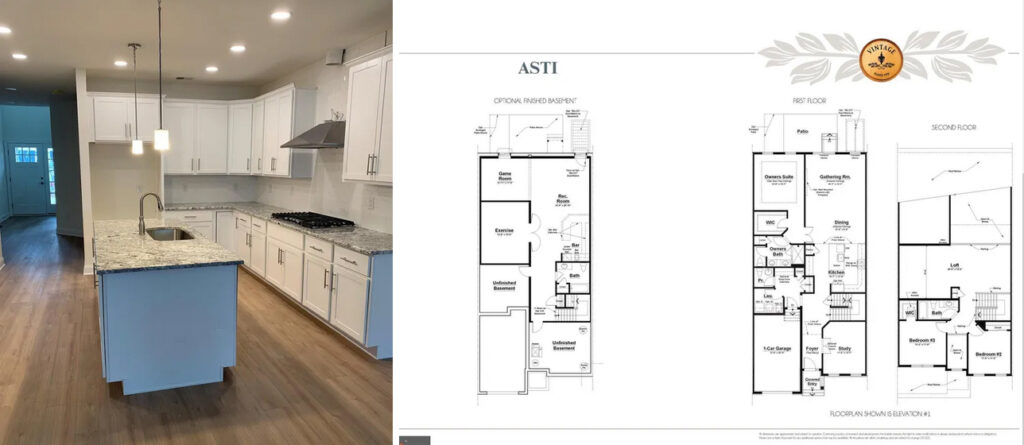

The manufactured housing segment has long contended with a reputation of being poorly made or cheap. Companies say the latest designs are modern and often energy-efficient and are built to withstand even the most severe weather.

Manufactured homes are built in a factory and then assembled onsite. This allows homes to be built faster and cheaper.

Some builders and developers hope that home buyers who may be locked out of homeownership may consider manufactured housing as an option. Also, lenders and developers are showing more interest in manufactured housing, believing it could help with housing inventory and affordability challenges.

“We have a lot of teachers, first-time home buyers, and folks downsizing after retirement,” Dustin Arp, managing partner of Spark Homes LLC, which has developed manufactured home communities, told The Wall Street Journal. “Maybe they used to qualify for site-built housing but no longer do.”

A new single-family built on site sold for about $392,000, on average, in 2020; subtracting the cost of the land, the house itself cost about $309,000, The Wall Street Journal reports, citing government data. For comparison, new manufactured homes cost $87,000, excluding the land.

More than 100,000 new manufactured homes are to be built this year, the highest amount since 2006, according to U.S. Census Bureau data.

But the sector may still need to convince buyers about manufactured housing as a cost-effective alternative. The homes are often sold by dealerships. They may offer limited financing options. “In those cases, a person might buy a manufactured house as a piece of personal property, like a car, rather than getting a mortgage that tethers the house to underlying land,” according to The Wall Street Journal.

Further, about 42% of manufactured homes are purchased with loans secured by the home. Those purchases do not include the plot of land, according to the Consumer Financial Protection Bureau. The loans could come with higher interest rates, and owners may be at greater risk of losing their homes if they don’t own the land as well, The Journal says.

Recently, Fannie Mae and Freddie Mac have adopted new programs to make it easier for lenders to extend conventional mortgages on certain manufactured homes, including those that have features like porches or garages built on site.

©National Association of REALTORS®

Reprinted with permission