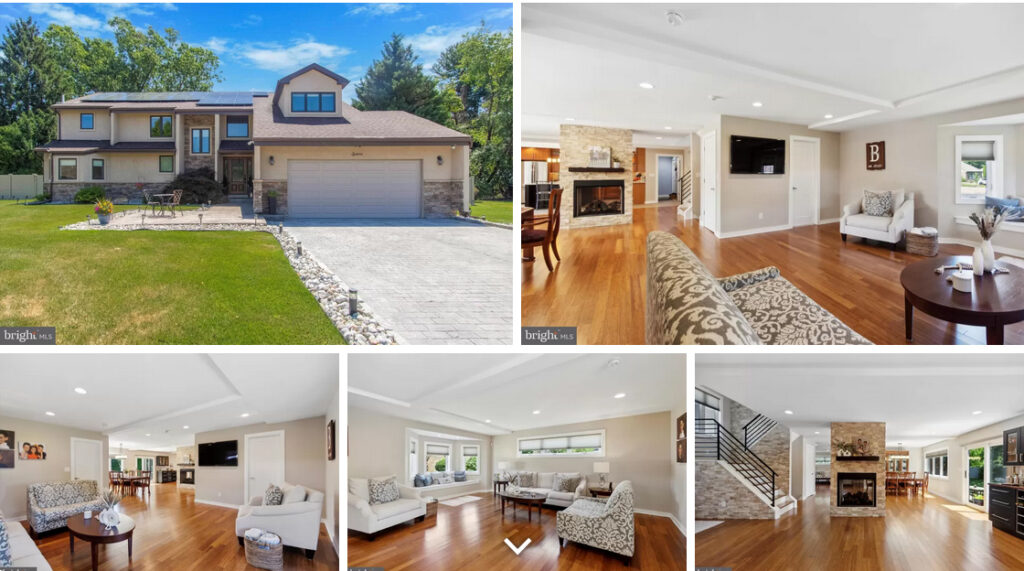

35 Hillside Rd. Broomall, PA. 19008

$375,000

Est. Mortgage $2,503/mo*

2 Beds

2 Baths

1158 Sq. Ft.

Listing courtesy of Bob Kline – BHHS Fox & Roach Wayne-Devon

Description about this home for sale at 35 Hillside Rd. Broomall, PA. 19008

Not your typical Marple Gardens Ranch. 2 additions and a 1/2 bath have been added and the rooms have been reconfigured. This home features a 1st floor laundry/mud room, 1.5 car detached garage with a driveway that can easily handle 4+ cars, Main Bedroom with 1/2 bath and access to huge 2 tiered deck, Family Room w/ sliders to same 2 tiered deck, dining area with sliders to a side screened in deck, “Bruce” Hardwood flooring throughout the home, Stucco Exterior and Central Air are some of the features of this home. Located on a quiet, no cut through, street within highly desirable Marple Newtown Schools. Easy access to all major highways and public transportation.

Home Details for 35 Hillside Rd

| Interior DetailsBasement: Partial,Poured Concrete,UnfinishedNumber of Rooms: 6Types of Rooms: Basement |

| Beds & BathsNumber of Bedrooms: 2Main Level Bedrooms: 2Number of Bathrooms: 2Number of Bathrooms (full): 1Number of Bathrooms (half): 1Number of Bathrooms (main level): 2 |

| Dimensions and LayoutLiving Area: 1158 Square Feet |

| Appliances & UtilitiesUtilities: Cable Available, Cable, Fiber Optic, Satellite Internet ServiceAppliances: Dishwasher, Dryer – Electric, Oven/Range – Electric, Refrigerator, Washer, Water Heater, Electric Water HeaterDishwasherLaundry: Main LevelRefrigeratorWasher |

| Heating & CoolingHeating: 90% Forced Air,OilHas CoolingAir Conditioning: Central A/C,ElectricHas HeatingHeating Fuel: 90 Forced Air |

| Fireplace & SpaNo Fireplace |

| Gas & ElectricElectric: 100 Amp Service |

| Windows, Doors, Floors & WallsWindow: Window TreatmentsFlooring: Wood |

| Levels, Entrance, & AccessibilityStories: 1Number of Stories: 1Levels: OneAccessibility: NoneFloors: Wood |

| Exterior Home FeaturesRoof: AsphaltPatio / Porch: Deck, Porch, ScreenedOther Structures: Above Grade, Below Grade, OutbuildingExterior: Street Lights, SidewalksFoundation: Concrete Perimeter, PermanentNo Private Pool |

| Parking & GarageNumber of Garage Spaces: 1Number of Covered Spaces: 1Open Parking Spaces: 4Other Parking: Garage Sqft: 300No CarportHas a GarageNo Attached GarageHas Open ParkingParking Spaces: 5Parking: Garage Door Opener,Oversized,Asphalt Driveway,Paved Driveway,Detached Garage,Driveway |

| PoolPool: None |

| FrontageResponsible for Road Maintenance: Boro/TownshipRoad Surface Type: Black TopNot on Waterfront |

| Water & SewerSewer: Public Sewer |

| Farm & RangeNot Allowed to Raise Horses |

| Finished AreaFinished Area (above surface): 1158 Square Feet |

| Days on Market: 1 |

| Year BuiltYear Built: 1950 |

| Property Type / StyleProperty Type: ResidentialProperty Subtype: Single Family ResidenceStructure Type: DetachedArchitecture: Ranch/Rambler |

| BuildingConstruction Materials: StuccoNot a New ConstructionNo Additional Parcels |

| Property InformationCondition: GoodIncluded in Sale: Washer, Dryer And Refrigerator All In “as-is” ConditionParcel Number: 25000220600 |

| PriceList Price: $375,000Price Per Sqft: $324 |

| Status Change & DatesPossession Timing: Immediate |

| MLS Status: COMING SOON |

| Direction & AddressCity: BroomallCommunity: Marple Gardens |

| School InformationElementary School: WorrallElementary School District: Marple NewtownJr High / Middle School: Paxon HollowJr High / Middle School District: Marple NewtownHigh School: Marple NewtownHigh School District: Marple Newtown |

PLEASE NOTE: Some properties which appear for sale on this website may no longer be available because they are under contract, have sold or are no longer being offered for sale. Please Contact Me for more information about this home for sale at 35 Hillside Rd. Broomall, PA. 190088 in Delaware County and other Homes for sale in Delaware County PA and the Wilmington Delaware Areas:

Anthony DiDonato

ABR, AHWD, RECS, SRES, SFR

CENTURY 21 All-Elite Inc.

Home for Sale in Delaware County PA Specialist

3900 Edgmont Ave, Brookhaven, PA 19015

Office Number: (610) 872-1600 Ext. 124

Cell Number: (610) 659-3999 {Smart Phones Click to Call}

Direct Number: (610) 353-5366 {Smart Phones Click to Call}

Fax: (610) 771-4480

Email: anthonydidonato@gmail.com

Call me for info on this home for sale at 35 Hillside Rd. Broomall, PA. 19008

Listing courtesy of Bob Kline – BHHS Fox & Roach Wayne-Devon