Lenders Set to Resume Foreclosures in July

Pandemic-related moratoriums on foreclosures and evictions are set to expire June 30, and some lenders plan to start resuming foreclosures in July. About 2.1 million homeowners are still in mortgage forbearance, according to the Mortgage Bankers Association. As of April, about 1.8 million households who aren’t in forbearance were 90 days delinquent on their loan, according to Black Knight data.

Bank of America says its suspension of foreclosures will end on bank-owned loans and government-backed loans when the national moratorium ends at the end of June. “The good news is the amount of deferrals is way down, and most of the clients have become current,” Brian Moynihan, CEO of Bank of America, said at this week’s Senate hearing, as reported by CNBC. “Irrespective of that deadline passing, we’ll continue to work with a few clients we have left to help them.”

JPMorgan Chase also said during the hearing that about 90% of its customers have exited forbearance programs.

Forbearance and delinquency rates have gradually dropped since the nation started reopening last summer. Nearly 92% of mortgage holders were making loan payments as of April 23, the largest share for any month since the onset of the pandemic, Black Knight reports.

Some lending giants plan to delay taking any action against delinquent homeowners even after federal moratoriums expire. For example, Wells Fargo told lawmakers this week that it plans to extend moratoriums on foreclosures and evictions for loans that they own until the end of the year. Wells Fargo also said it supports the Consumer Financial Protection Bureau’s proposed rule that would prevent lenders from initiating foreclosure proceedings until 2022.

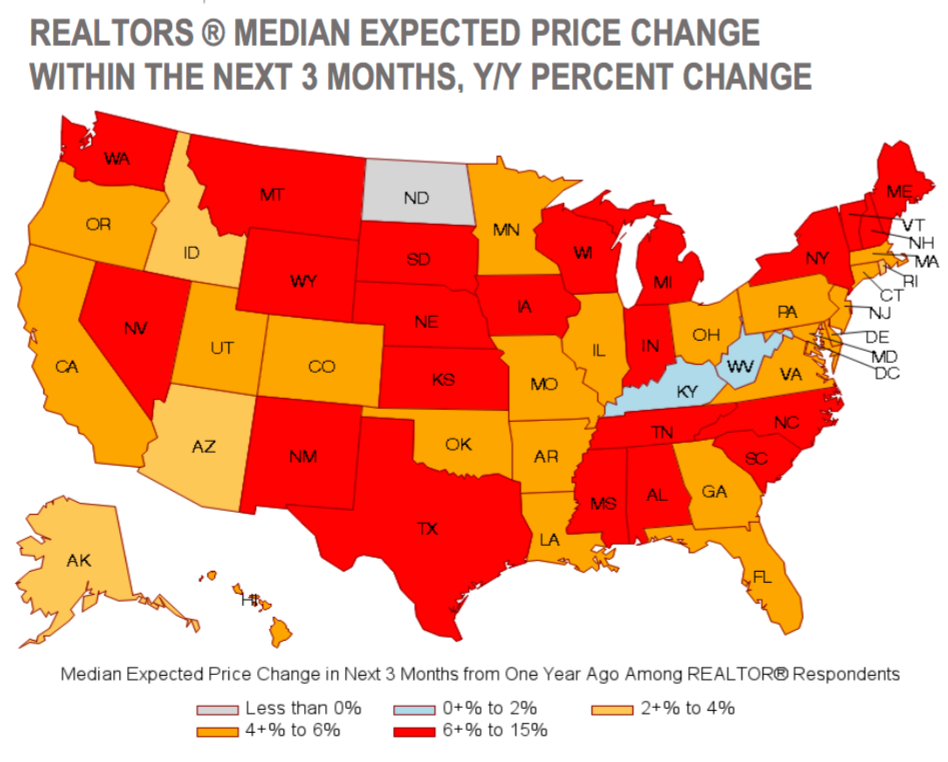

The housing industry is anticipating more inventory in the coming months. Lawrence Yun, chief economist at the National Association of REALTORS®, said after last week’s existing-home sales report: “We’ll see more inventory come to the market later this year as further COVID-19 vaccinations are administered and potential home sellers become more comfortable listing and showing their homes. The falling number of homeowners in mortgage forbearance will also bring about more inventory.”

Reprinted with permission