Technology REALTORS® Use the Most

REALTORS® use multiple technology platforms daily to promote their business and stay connected to clients. While smartphones and email are key tools that facilitate most of those connections, 53% of REALTORS® also use social media apps or GPS features daily, according to the National Association of REALTORS®’ 2022 Member Profile.

Typing proves more popular than talking to clients. According to the survey, 94% of REALTORS® say they prefer to communicate with their clients over text message, followed by telephone (92%) or email (90%). About 27% of REALTORS® say they prefer to use video chat to connect with customers.

Here’s a snapshot of more technology use among REALTORS®.

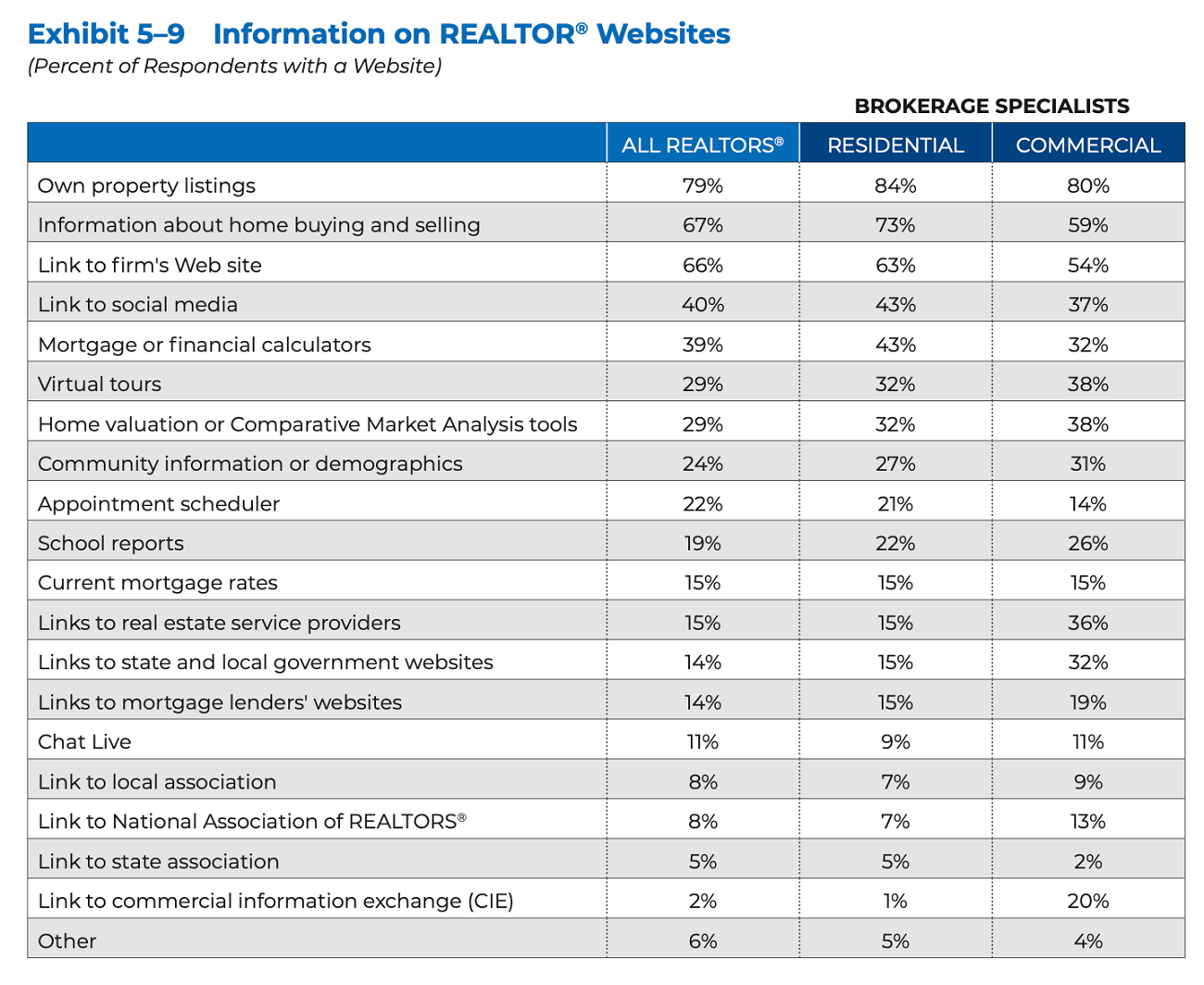

Keeping a website presence: Websites continue to be a big piece of maintaining a digital presence online. Eighty-four percent of REALTORS® say they included their own property listings on their residential brokerage website, along with home buying and selling information, links to their brokerage’s website, social media links, and mortgage or financial calculators. Commercial brokerage specialists were more likely to include links to the commercial information exchange, virtual tours, comparative market analysis, and the National Association of REALTORS® on their websites.

While websites are viewed as a key tool among real estate professionals, 57% of REALTORS® reported bringing in no inquiries or business directly from their website; 27% cited one to five inquiries from their website.

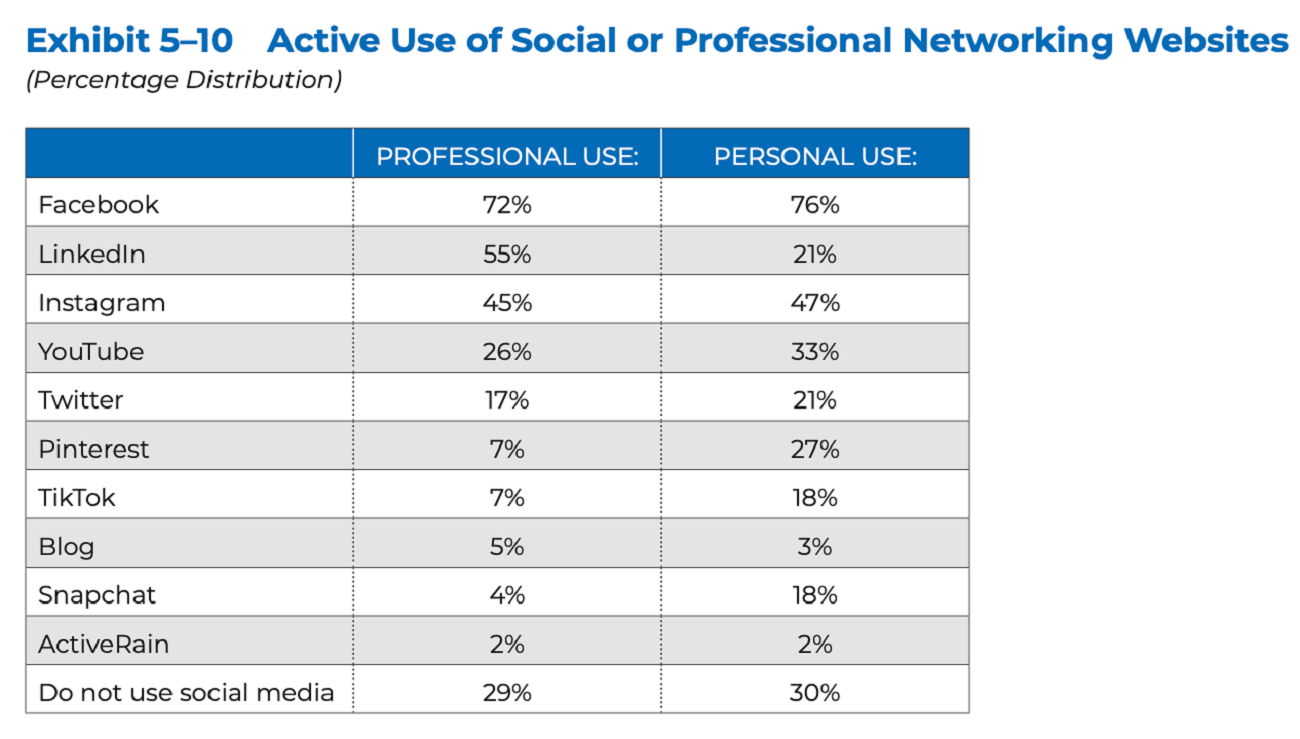

Staying connected on social media: Seventy-two percent of members say they use Facebook for professional use; 55% use LinkedIn; and 45% use Instagram professionally. Still, more than a quarter of members—or 29%—say they do not use social media at all for their business. (View: 7 Tips to Help Brokers Master Social Media and Develop a Growth Strategy for Your Social Media Content)

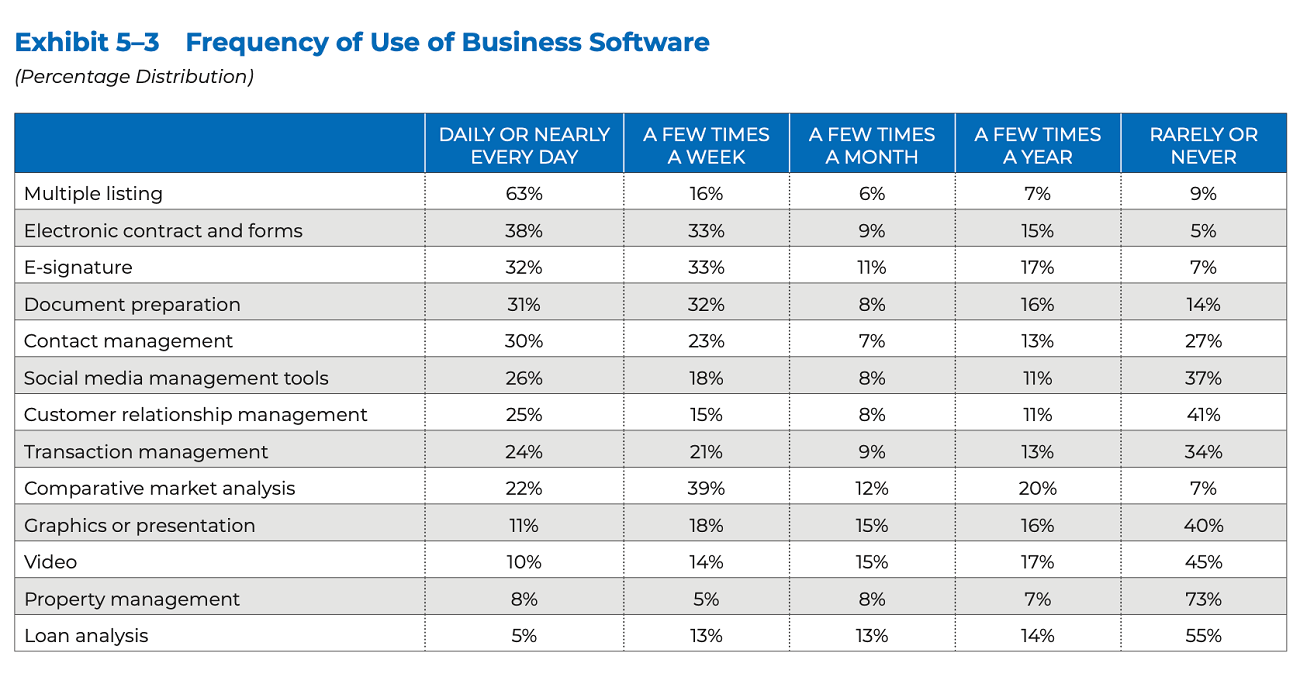

Leveraging business software: Sixty-three percent of REALTORS® use MLS software every day. Other software used regularly includes electronic contracts and forms, along with e-signature, document preparation, contact management, and social media management tools, the survey shows.

©National Association of REALTORS®

Reprinted with permission