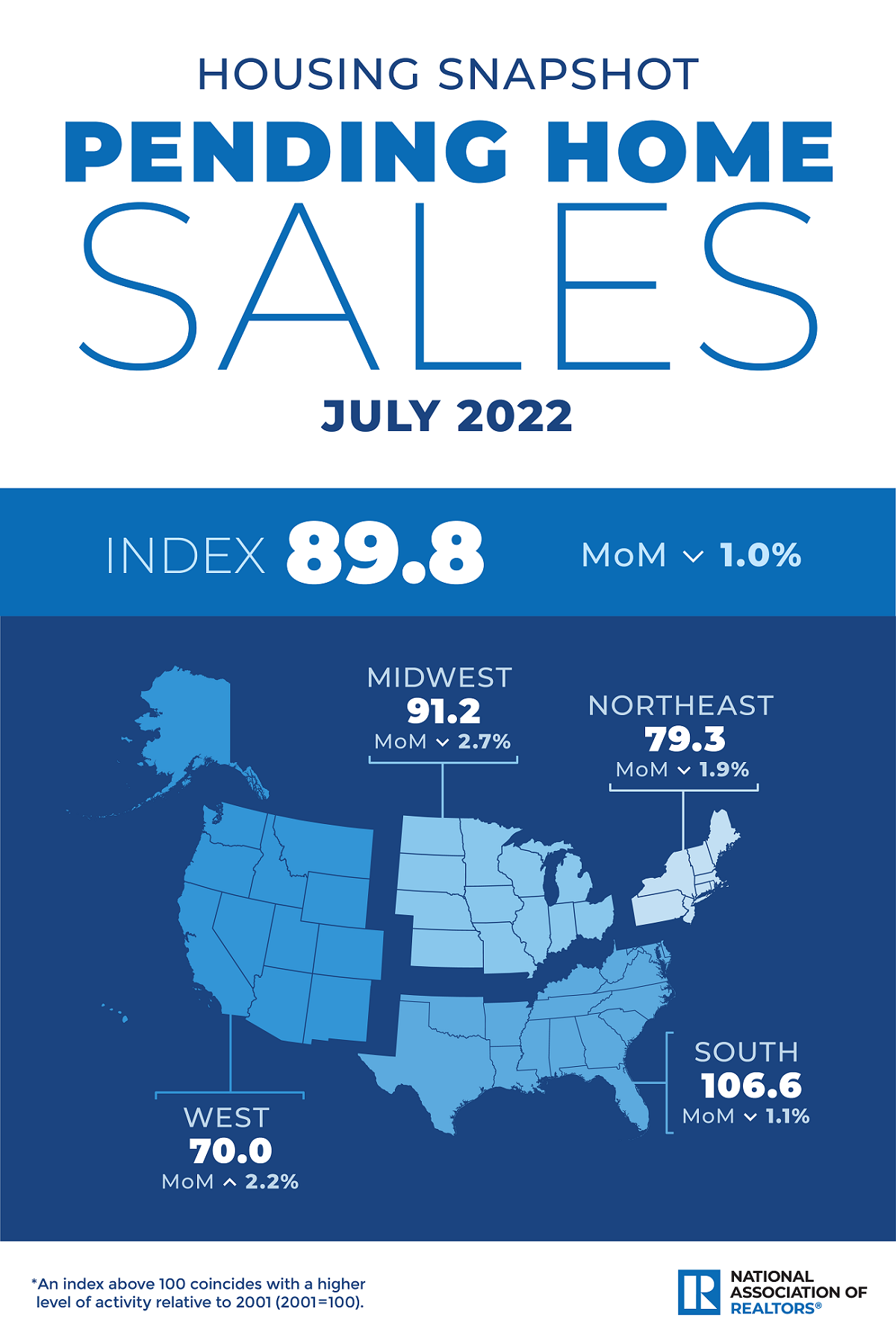

Pending home sales in July dropped nearly 20% year over year as the housing market continues to slow. But a turnaround is in sight, says Lawrence Yun.

Home buyers continue to recoil from higher mortgage rates and home prices, with pending home sales in July plummeting nearly 20% year over year, according to data from the National Association of REALTORS® released Wednesday. Though summertime is traditionally busy for the real estate market, contract signings across all regions of the country were down by double-digit percentages annually, the data shows. The West has seen the most market contraction, with pending home sales down 30%.

Pending home sales have fallen in eight of the last nine months as the market retreats from its pandemic highs. Still, NAR Chief Economist Lawrence Yun says a turnaround is likely. “In terms of the current housing cycle, we may be at or close to the bottom in contract signings,” he says. “This month’s very modest decline reflects the recent retreat in mortgage rates. Inventories are growing for homes in the upper price ranges, but limited supply at the lower price points is hindering transaction activity.”

Affordability is taking a big hit, too, plunging in June to its lowest level since 1989, NAR reports. Rising mortgage rates have made home loans more expensive, adding to the cost of homeownership. The typical monthly mortgage payment was nearly $2,000 in June, up 54%—or $679—compared to just one year ago. “Home prices are still rising by double-digit percentages year over year, but annual price appreciation should moderate to the typical rate of 5% by the end of this year and into 2023,” Yun says. “With mortgage rates expected to stabilize near 6% alongside steady job creation, home sales should start to rise by early next year.”

©National Association of REALTORS®

Reprinted with permission