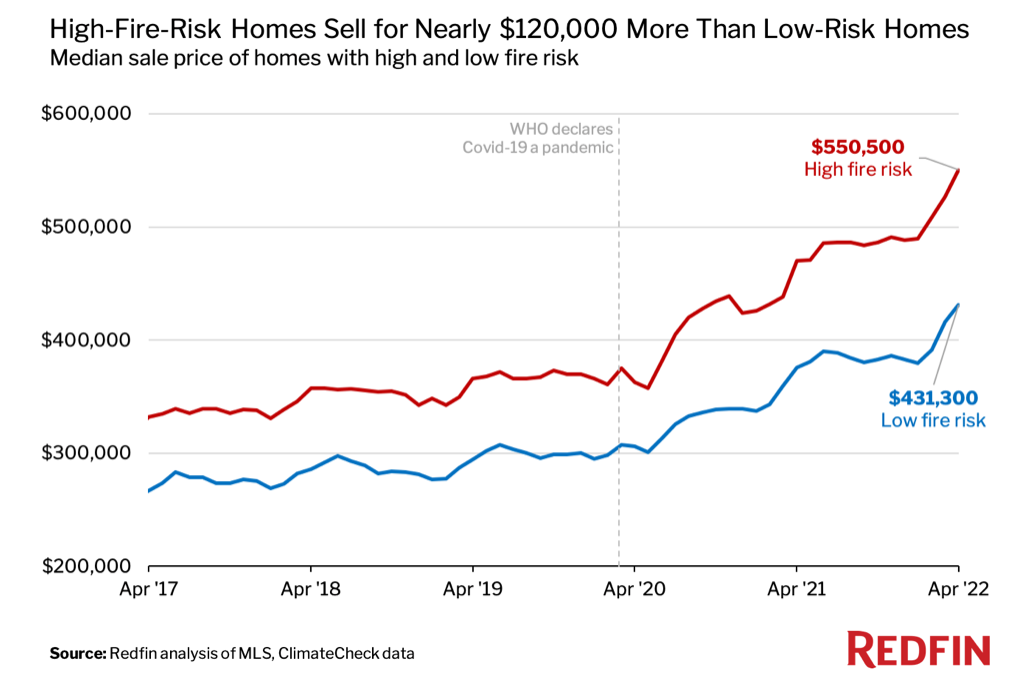

Homes With Higher Fire Risk Sell for Nearly $120K More

The risk of a house fire isn’t slowing buyers in this market frenzy. The median sale price of homes that have conditions creating a high risk of fire was $550,500 in April, compared to $431,300 for homes with a low risk of fire, according to a new study from Redfin.

The typical home with a high risk of fire sold for $119,200—or nearly 28% more—than the typical home with a low fire risk. That marks the largest premium in dollar terms since at least 2017, Redfin reports.

Homes that could be susceptible to fires have historically been more expensive because they are generally larger and located in pricier areas along West Coast metros. But the price premium for high-risk homes has climbed more since the pandemic began.

Many Americans have moved from cities to suburbs and rural areas where homes often are at greater risk due to their proximity to flammable vegetation, the Redfin study notes. The median sale price of high-risk homes climbed by nearly 52% in April compared to two years earlier. The median sales price of lower-risk homes rose by 41%.

“Suburban homes tend to be more expensive because they’re large, and demand for large homes skyrocketed during the pandemic as Americans sought respite from crowded city life,” says Sheharyar Bokhari, Redfin’s senior economist. “Pandemic buyers also hunted for deals due to surging home prices, and while fire-prone homes aren’t cheaper on average, buyers may feel they’re getting more bang for their buck because they’re getting more space. And for some pandemic buyers, the fire-prone home they bought in suburbia was actually cheaper than their last home because they were relocating from somewhere like San Francisco and Seattle.”

Source:

“Homes With High Fire Risk Sell for Nearly $120,000 More Than Low-Risk Homes as Americans Flock to Fire-Prone Suburbia,” Redfin (June 6, 2022)

©National Association of REALTORS®

Reprinted with permission