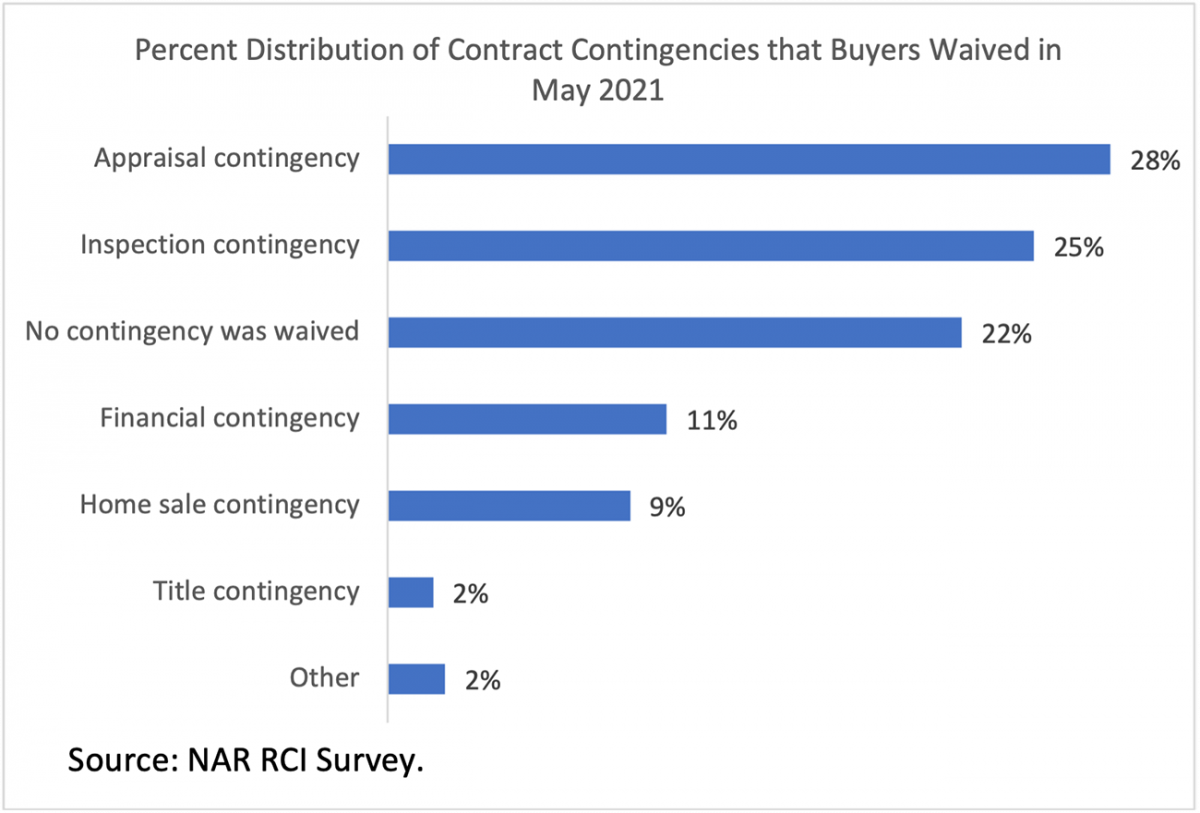

Buyers Waive Contingencies

To win a bidding war, more buyers are waiving appraisal and inspection contingencies, according to the latest REALTORS® Confidence Index survey. Home buyers most commonly are waiving the appraisal contingency (28%) and the inspection contingency (25%), shows the survey of more than 3,300 REALTORS®.

The buyers waiving contract contingencies are those who are either paying cash or using conventional financing.

Buyers using FHA or VA loans can’t waive the appraisal or inspection contingencies due to financing guidelines, Gay Cororaton, research economist for the National Association of REALTORS®, writes on NAR’s Economists’ Outlook blog. Therefore, those buyers may be at a competitive disadvantage compared to other buyers who don’t have to follow certain financing rules. For example, FHA inspection standards require that components of a home are in good working condition, such as the heating unit, water heater, and smoke detectors. FHA buyers are unable to waive the inspection to compete and still get their loan.

“In a housing market where sales are moving swiftly, the time to undertake the inspection and appraisal is creating a hurdle for buyers obtaining FHA-insured loans, who are typically first-time buyers, and buyers obtaining VA-guaranteed loans,” Cororaton writes.

Buyers also must compete against those who are bringing more money to close. The share of mortgages with at least a 20% down payment increased to 52% in May, up from about 40% in 2011, the NAR survey shows. Nearly one in three first-time buyers made a down payment of at least 20%, up from about 25% in 2011.

Home buyers with conventional financing are edging out those with FHA and VA loans, which offer low down payment financing. Conventional conforming mortgages, which conform to guidelines set by Fannie Mae and Freddie Mac, accounted for 74% of mortgages issued in May, an increase from 65% in 2018. On the other hand, the share of FHA-insured mortgages comprised 14% of mortgages in May. In past years, that percentage was around 20%. Also, the share of VA-guaranteed loans fell to 7% in May, down from its 10% average in recent years.

Real estate pros report that VA loans, for example, have a reputation for receiving low appraisals that can make it difficult for buyers to compete in an environment where home prices are escalating quickly. VA appraisals often can average five to 15 days to complete—a lengthier timeline than many other loans. “It is extremely difficult for FHA/VA buyers to get accepted in a multiple-offer situation,” writes one real estate pro in the REALTOR® survey. “They are on the bottom of the hierarchy.”

Reprinted with permission